|

This issue of NanoNews-Now covers Investing in Nanotech. Nanotech investing guru Jack Uldrich presents an article titled An Investor's Guide to Nanotech Indices.

In a second article on nanotech investing, Evan J. Hoobchaak (a financial planner based in Chicago) contributes an article which focuses on the opportunities for individual (i.e., retail) investors titled Nanotech Investing for the Regular Joe: Opportunities for Non-Institutional Investors.

And in the 4th of 6 articles on Building The Winning Nano Venture Team, Bo Varga covers Hiring, Motivating, Retaining Key Employees - the CEO example.

|

If you are a Nanotechnology investor, click here for important information that could change the way you invest.

Find the nanotech patent information you are looking for faster, easier, and in greater detail than any other publication - GUARANTEED.

"The NanoTech Transfer Report provides me with the information I need to stay in touch with the leaders in the field. Great product!"

— Douglas W. Jamison, Vice President Harris & Harris Group Inc. www.hhgp.com

Try it FREE for 60 days! There is NO RISK.

|

|

|

Table of contents:

Jack Uldrich

Evan Hoobchaak

Bo Varga

Quotes

News

Useful Links

Next Issue

Glossary

Editorial Calendar

About Us

Advertise

Contact

|

|

|

|

|

|

|

|

University Technology Transfer & Patents

Learn More |

|

Only the news you want to read!

Learn More |

|

|

|

Full-service, expert consulting

Learn More |

|

Advertisement

|

|

|

Over two years ago, on April 1, 2004, Merrill Lynch, with great fanfare, unveiled the first index to track the emerging field of nanotechnology as a market force. Within days, however, the timing of Merrill Lynch release-April Fool's Day-was brought into question as the company had to embarrassingly retract a number of companies from its index and admit that they had little or nothing to do with nanotechnology.

The event temporarily slowed-but did not stop-the creation of similar indexes. Within the past six months, the floodgates have opened and there are now no less than seven nanotechnology indices. These include: Lux Research's Nanotechnology Index; the ISE-CCM nanotechnology index; the Newbridge Nanotechnology Index; the Global Crown Capital Index; Innovest's Nanotechnology Index; Punk & Ziegel's Nanotechnology Index; and Nanotechnology.com's "Small Technology" Index. (Merrill Lynch's index is no longer publicly available).

The sheer number, not to mention the disparity of the number of company's listed in each index (the indices range in size from 15 to 30 companies), is enough to cause the average investor's head to spin.

The problem stems from a couple factors. First, the term "nanotechnology" still means slightly different things to different people. As such, whether or not a company is actually manipulating atoms to tap into the unique properties that manifest themselves at the nanoscale is still subject to a range of differing opinions.

The second difference centers on how much significance is accorded to nanotechnology equipment and materials companies. There is no question that such companies belong on the indices. The question is how much weight should be given to these particular sub-sectors. The majority of the indices allocate approximately 25 percent of their weight to equipment and materials manufacturers. ISC-CCM and Newbridge, however, allocate closer to 40 percent to their indices. Nothing is necessarily wrong with the latter approach-especially in the early stages of nanotechnology's growth where equipment and materials may very well make up a larger part of its growth. I simply feel those indices favoring a slightly smaller allocation will better capture nanotechnology's true impact on the overall market.

The third difference between the indices centers on their willingness to include large cap companies such as Intel, 3M, GE, BASF and IBM in their mix. The argument in favor of including such behemoths is that all are heavily engaged in nanotechnology research and development. It is a position that I personally support, and the index that includes the most large cap companies is the Lux Research Index. Lux's rational is that these companies are also nanotechnology "end-users." That is, these firms aren't just engaged in R&D, they are also incorporating nanotechnology into improving their existing products and, by extension, boosting their annual revenues.

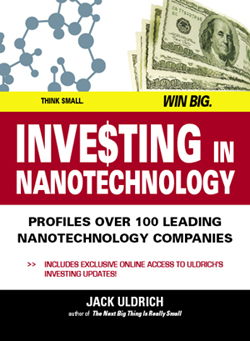

Investing In Nanotechnology: Think Small, Win Big.

|

The counter-argument is "neither incremental advances in product development or nanotechnology R&D add much in the way of immediate revenues to the company's bottom-line." Therefore, given the size of these corporations, any increase/decrease in their respective stock prices will shift the indices in a manner that is not a fair reflection of nanotechnology's true impact. If you agree with this argument, the Global Crown Nanotechnology Index does the best job of tracking nanotechnology from a "pure-play" perspective. It tracks only small and mid-cap nanotechnology companies.

In the final analysis, the simple truth is that there is a great deal of overlap between the indices. Commonly listed companies include: Accelrys, Altair, Arrowhead Research, FEI Company, Flamel, Headwaters, Nanophase, Symyx, Harris & Harris, and Veeco Instruments. Thus, while there will obviously be some disparity at the precise rate at which the various indices move, my guess is that they will all generally move in the same direction. (There is only one index that is sufficiently different from the others and that is Innovest's Nanotechnology Index. It includes a couple of companies that have not previously been listed as nanotechnology companies [e.g. ApNano, Plug Power, Nalco and Spire Corporation]. And, to be fair, all of these companies could very well be applying various aspect of nanotechnology to the development of new nanomaterials, fuel cell technology and water filtration, and I am simply not aware of it.)

My personal favorites are Lux Research's Nanotech Index and Nanotechnology.com's "Small Technology" Index. I like the former because the staff at Lux Research has a solid methodology for listing (or not listing) specific nanotechnology companies. Moreover, the index is used as the basis for the PowerShares Nanotech Exchange Traded Fund and is therefore easy to follow. (To date, the EFT is up nearly 20 percent since its inception in October of 2005.)

I am also a fan of Nanotechnology.com's "Small Technology" Index. It is easily accessible from the company's website and is continuously updated. Both characteristics allow the average investor to track the index's overall movement as well as track which nanotechnology company's stocks are up and which are down at any given moment in time.

(The author is not affiliated with either index in any capacity.)

Disclosure statement:

Mr. Uldrich may own shares in any or all of the companies mentioned in this article.

Disclaimer statement:

This is not an offer to buy or sell securities. Due to the rapidly changing nature of the nanosciences, investors are strongly advised to conduct their own due diligence before acting on any advice in this article. Neither Mr. Uldrich or Nanotechnology Now assumes any responsibility for your investment decisions.

|

Jack Uldrich is the author of the award-winning, bestseller, The Next Big Thing is Really Small: How Nanotechnology Will Change the Future of Your Business (1), and President of The NanoVeritas Group - an international leadership and technology consultancy dedicated to helping business, government, and non-profit organizations prepare for and profit from the emerging field of nanotechnology. Clients include Fortune 100 companies, venture capital firms and state and regional governments.

Uldrich's forthcoming book, Investing In Nanotechnology: Think Small, Win Big was published March 2006, and his written works have also appeared in The Motley Fool, The Futurist, The Scientist, CityBusiness, The Futures Research Quarterly, TechStation Central and scores of other newspapers around the country.

Uldrich is a frequent speaker on the nanotechnology lecture circuit and has addressed numerous businesses, trade associations and investment groups, including General Mills, Pfizer, and the U.S. Chamber of Commerce.

(1) Read our review

|

|

Nanotech Investing for the Regular Joe:

Opportunities for Non-Institutional Investors

By Evan Hoobchaak

|

Some feel that nanotechnology, with its myriad applications in everything from medicine to textiles, could be the next investment boom. But with institutional investors having a tremendous advantage over information and money, the individual investor may see nanotechnology and feel like he or she is missing the wave. Evan Hoobchaak, a financial planner in Chicago, explains in the recent issue of Nanotechnology Law & Business how an individual investor today can "play" nanotechnology. These opportunities include: (1) large-cap companies, (2) small- to mid- cap companies, and (3) indices and holding companies.

1. Large-Cap Companies

The first option is to invest in large, more established companies that are using nanotechnology applications in current products, or who are exploring the use of nanotechnology through their research and development divisions. Although it is not a direct nanotechnology "play," these stocks may provide the individual investor with a more stable portfolio, while still having the opportunity to be on the forefront of the new technology. That is, because these larger companies have diversified businesses, not all of their revenue would come from nanotechnology or would be dedicated to the development of nanotechnology. So any effect of nanotechnology on their profitability and stock price, good or bad, would be diminished. Some stocks that would fit these criteria would be International Business Machines (IBM), Hewlett Packard (HPQ), General Electric (GE), 3M (MMM), Toyota (TM), Dupont (DD), Intel (IN), and Basf (BF), although many others exist. (This listing is not a recommendation to buy or sell securities) These large capitalization companies are certainly recognizable to most individual investors, however, not many of these investors would realize that these stocks provide exposure to nanotechnology through their business activities. Another way to think about it is that the investor would be investing in companies that, in fact, invest in nanotechnology themselves.

2. Small- and Mid- Cap Companies

If more direct exposure is the goal of the investor, there are certainly opportunities to invest in businesses whose main revenue source is primarily driven through the application of nanotechnology processes. These stocks will also tend to be more volatile as their businesses are not as well diversified as the aforementioned companies. However, the potential gains for the individual investor can also increase because of the stock's direct involvement with the application and development of nanotechnology. Most of these pure nanotechnology companies will have smaller capitalizations as well. Some of the larger, and possibly less volatile, of these small cap pure nanotech plays could include Veeco Instruments (VECO), Flamel Technologies (FLML) and FEI Company (FEIC). On the smaller and possibly more volatile side, examples could include Immunicon (IMMC), Accelrys (ACCL), Lumera (LMRA), Altair Nanotechnologies (ALTI), Nucryst Pharmaceuticals (NCST), and Biophan Technologies (BIPH). (This listing is not a recommendation to buy or sell these securities) The other risk typically associated with all of these often smaller companies, is that although nanotechnology the industry may perform well, the company and its stock, for any number of reasons, will not.

Either because of poor management, poor execution, or simply not applying nanotechnology developments to the correct products, the stock price may not follow the possible general uptrend. In the beginning of any industrial cycle, there are companies that fail despite the tremendous opportunity laid out for them. So the "average Joe" should not be fooled into thinking that by simply purchasing the stock of any smaller company involved in nanotechnology, he will make money if the industry as a whole takes off. One way to avoid this pitfall is to rely on research done by professional analysts on the inner workings of these smaller players in nanotechnology. Newsletters exist that can give even the "average Joe" a very good idea of why, or why not, a company may be a good investment. Doing one's homework in this case, can often shed light on which handful of stocks the individual investor should consider.

3. Indices and Holding Companies

Finally, if nanotechnology exposure is the goal, but the thought of sorting through the individual stocks sounds like a confusing or even scary idea, the "average Joe" has the option to leave this business to the professionals. Recently, Lux Research and PowerShares introduced an exchange-traded fund that intends to index nanotechnology, providing passive exposure to the industry as a whole. Although Merrill Lynch devised an unmanaged nanotechnology index (NNZ) a couple years ago to track the performance of approximately 27 stocks involved in the nanotechnology industry, investing in the index itself is not possible. The PowerShares Lux Nanotech Portfolio seeks to provide that broader nanotech exposure while managing the holdings and looking to outperform the unmanaged index. The portfolio trades on the American Stock Exchange under the ticker PXN.

There are also nanotechnology holding companies which can provide a similar type of investment approach by grouping together several nanotechnology stocks. One example is Harris and Harris Group (TINY) which itself owns a "basket" of private nanotechnology companies. Another example would be Westaim which invests in both publicly traded and private nanotech firms. It trades on the Toronto Stock Exchange under the ticker WED and on Nasdaq under the ticker WEDX. (Not a recommendation to buy or sell these holdings)

Certainly, other indices and mutual fund type nanotechnology investments exist, however, the majority of them at this point are either not traded or limited to private investors and institutions, and are therefore not readily accessible to the "average Joe" investor.

Conclusion

By employing simple investment strategies and by taking advantage of tools and research already available, it is possible for the average investor to participate in the potential gains afforded by the growing nanotech industry. However, it is most important to always keep things in perspective. Before any funds should be dedicated to stock investments, the individual investor should review the risk tolerance and goal of those funds. That is, if the investor could not tolerate losing some of that money, that money should not be invested. Keeping the big picture in focus and avoiding the trap of "get rich quick" investing can allow the individual investor to not only participate in the stock market, but to hopefully enjoy it as well.

Disclosure statement:

The author does not own stock in any of the companies in this article.

Disclaimer statement:

This is not an offer to buy or sell securities. Due to the rapidly changing nature of the nanosciences, investors are strongly advised to conduct their own due diligence before acting on any advice in this article. Neither Mr. Hoobchaak or Nanotechnology Now assumes any responsibility for your investment decisions.

|

Evan J. Hoobchaak is financial planner based in Chicago. He advises his private clients with regard to strategic investments (including stocks, bonds, mutual funds and limited partnerships), retirement planning and tax strategy.

He can be reached at ehoobchaak@gmail.com

For more information on the legal, business, and policy aspects of small scale technologies, visit Nanotechnology Law & Business.

|

|

Building The Winning Start-Up Team: Part 4 of 6

By Bo Varga

|

Introduction: Bo Varga has helped start-up & early stage high technology companies close funding, customers, and people, including recruiting senior technical and executive talent. Bo is currently recruiting team members for a nano separations start-up with major price-performance benefits in metals recovery for environmental, industrial, and mining applications. He is also consulting with a project for a media portal in China.

Article 1: Why Hire an External Recruiter? (Click here for a quote, and to here to buy.)

Article 2: Building The Winning Start-Up Team: Performance Requirements

Entrepreneurs, start-up teams, investors, and recruiters often intersect to match a startup with the experienced business management required for success.

Click here to read (for free) the rest of this report in full.

Article 3: The Recruiting Process

This article addresses the actual recruiting process an entrepreneur or team can use and the knowledge, background and reference checking to establish baseline trust in a new team member.

(Click here to buy.)

Article 4: Hiring, Motivating, Retaining Key Employees - the CEO example

Introduction:

Many nanotechnology startups are based on the work of a scientist or engineer, often with no business experience. These entrepreneurs often have a standard set of weak spots in their management skills - a lack of customer focus, little to no background in launching or heading a corporation, or simply a lack of awareness that they cannot drive a business as well as develop a technology and get a product to market. Even companies with the strongest potential and IP can become an unattractive investment decision if the right management team isn't in place and if a cooperative team environment is not established & maintained.

A cooperative work environment depends on trust. Trust can be built by communication & commitment to make and keep agreements. And is in part based on personal styles and chemistry and the resolution of disagreements or miscommunications.

Objectives: Upon completion of this article, you will understand the key concepts and costs relating to hiring, motivating, and retaining key employees, with a particular focus on the CEO.

1. The CEO in a start-up or early-stage nano company has to earn the trust of the entrepreneur and team. This can be achieved in part by achieving agreement on plans, in part by advising & mentoring, and in large part by achievements. He or she has four primary outside goals:

- close funding required - this is usually an ongoing process for the first 3-5 years of the company's life

- evaluate customer opportunities - a startup has the advantage of being able to rapidly change direction and successful companies focus on clearly set priorities but change rapidly to adapt to market realities

- close deals with allies, customers, licensees, vendors - outsiders want to deal with someone they feel has professional business commitment, experience, and habits

- recruit top quality people to build team, BOD, BOA - winning companies have winning teams

Trust is built each time progress on these four goals is achieved.

In general the inside goals for the CEO are:

- develop & monitor business & revenue models & plans

- motivate & focus team to achieve implementation goals

- financial oversight - "corporate governance"

- legal oversight - "corporate governance"

Here trust is based more on communication and style, demonstrating competency, explaining thinking and approaches to problem solving, listening and responding.

However the first hurdle for a nano start-up is to recruit a CEO. And the first hurdle when dealing with scientists and engineers is "letting go of baby". To be totally clear a CEO is responsible for all aspects of the company's operations and reports to - and is hired and fired by - the Board of Directors. Post funding this often means the investors.

Entrepreneurs often resist hiring a CEO as they wish to retain control, do not see the need at an early stage, and resent the compensation and cash outlay that hiring a CEO entails. Investors, especially Venture Capitalists, insist on a CEO or at least a temporary CEO from the start of a project. Investors do not want to play "catch up" on professional management of any aspect of the business function. Entrepreneurs often see professional management as a waste of their time and money.

The solution can be to define goals, priorities, and challenges that the nano start-up faces and to carve out those that the entrepreneur / founder either is unable or unwilling to undertake or will undertake only as a last resort. These are often the CEO functions, in particular as regards funds raising, business & revenue planning, and corporate governance.

A focus on the challenges of launching and growing a new venture can often bring an entrepreneur to accept the need for a CEO. Especially when that CEO has a proven track record in bringing products to market and growing start-ups into successful companies.

2: Hiring candidates in Silicon Valley is often difficult for two reasons, one of which is compensation. The other is the often self-centered approach of an entrepreneur, who does not consider the CEO candidate's point of view.

The Radford Benchmark Survey is the "Bible" for Silicon Valley compensation. Compensation for each executive position, CEO, CTO, etc. is segmented by lower 25%, upper 25%, and middle 50%. Compensation is also segmented by how much money the company has raised, less than $30 million, between $30 and $70 million, and more than $70 million.

As we work only with start-up and early stage companies, these numbers are substantially lower at funding levels typical for seed rounds - typically $500,000 to $1 million, A rounds - typically $3 million, or B rounds - typically $10 million.

CEO candidate for seed round companies start around $160,000 annual salary, with a bonus around 25% based on closing A round funding or joint venture, strategic alliance, government grants, etc. That is a target compensation of $200,000 in year 1 of a company's life post seed funding.

CEO candidates for seed round company are typically compensated with 10% - 15% of equity, 12% is average. This is usually based on the standard 4 year vesting and 1 year cliff, however there is often a sign-on stock bonus and accelerated vesting provisions based upon meeting or exceeding certain performance objectives - funding, customers, revenue, etc.

CEO candidates for A round (first major funding round closed) companies start around $200,000 annual salary, bonus of 30% - 40%, and 4% - 8% of equity.

What is often missing in the entrepreneur's thinking is the CEO's point of view. That is the entrepreneur is very aware of giving up control, stock, and money - and often to a CEO who has to be educated in the technology and sometimes in the business opportunities of the nano company. The entrepreneur is often not conscious of what the CEO is risking.

A CEO brings to a new venture his or her credibility, network of relationships among investors, customers, industries, and markets, and reputation. That is, the past performance of the CEO brings immediate credibility and value to a new venture - we believe a CEO adds at least $1 million to the valuation of a start-up nano company for funding purposes.

Not only is the CEO risking his or her career but he or she is also suffering an opportunity cost - commitment to one venture means the lack of ability to participate in another.

The entrepreneur has to sell and educate a successful, professional executive on the entrepreneur, the technology, the business prospects, and so on.

Any professional investor in high technology will tell you that professional CEOs are the limiting factor on the deals that get funded - there is a lot of great technology, opportunities, and markets, but a shortage of CEOs.

The entrepreneur's "baby" is often not funded or funded for six months and therefore very high risk. Luckily CEOs are not lacking in self-confidence, but they still need to be sold.

These comments generally hold for other executive and senior technical talent. That is, these people have a wealth of opportunities and need to be sold on joining a new venture.

3. Motivating & Retaining are key to business success, motivation is viral - it is communicated to each team member and to customers, investors, and other "outsiders". Positive motivation can solve many problems and overcome many concerns and help resolve inevitable missteps, miscommunications, and so on.

Retention is key to both implementation of business & revenue plans and can be a major cost savings. Losing a productive team member is potentially a failure of communication, reduces resources and can lead to missing company commitments or deadlines (or worst case can kill a company), and increases cost. Costs include replacement costs - whether paid to an outside recruiter or time and energy committed internally - as well as training / bring up costs associated with a new team member coming up to speed and achieving trust and productivity.

"Success has a thousand parents and failure is an orphan" certainly is a major factor in motivation and retention of the team. And in recruitment of additional team members.

Success at meeting product, revenue, market, and other goals is a major contribution to positive motivation and retention. Everyone wants to participate in success - friends, husbands, "significant others", wives, all provide significant positive reinforcement to people who participate in a success. And financial success is one important aspect of stress reduction and happiness.

Leadership by example, whether in hours worked, commitment kept, plans made - communicated - and achieved, and listening and responding appropriately to the problems and concerns of each team member - all these are key factors in motivation and retention.

Communication - both about the company, expectations for each team member, recognition for contributions, etc. and social interaction - picnics, parties, etc. are key ingredients in creating and maintaining "we are working together as part of the same team" dynamic.

4. Termination is the other side of motivation and retention, that is the out-placement of people who are inappropriate for the company. For both legal and team reasons out-placement has to be handled with caution.

Of course the case of illegal activity is straightforward - the offending person should be dismissed from the company.

Despite trial periods of initial employment and "at will" employment, the company needs both a formal process for out-placement and internal communication re performance expectations to avoid negative impacts on team morale.

While a Reduction In Force (RIF), that is abolition of a job position, can be used for outplacement, in our opinion this should only be done as a last resort or as when forced by financial problems.

The more general process is to (i) formal dialog with the team member which defines the problem, states what has to be done to correct the problem, gives a reasonable time period to correct the problem, and allows the team member to put his or her position on a formal record kept in the employees personnel files. If the problem persists then (ii) another formal dialog repeats (i), however a "drop dead" date is defined by which the problem must be cured or employment terminated. If the problem persists then (iii) the outplacement interview completes the personnel file and the employee is paid all compensation due and is terminated. This is often done with two weeks notice - if the relationship is cordial then the employee may be permitted the use of an office and phone while seeking new employment, if not then the employee permanently leaves the company, after returning all company assets and review with management of the relevant Non Disclosure, Intellectual Property, and other agreements.

As a side note, the issue of references should be addressed upon initial hiring. That is, some companies will only verify employment dates and title and will not provide references. Others will provide references. This should be in the Employee Handbook, along with other company policies including Termination of Employment. As references can be an important factor in future employment, it is very important both for the company and the employee to define and implement a company policy.

From the recruiter side we often have to go to outsiders - customers, investors, and vendors - or to other people who have left the company for references for employment at some companies.

The last two articles in this series will cover (#5) what investors and customers look for in start-up companies and (#6) identifying gaps in team capabilities and understand how to fill those gaps through employees, consultants, and advisory & director boards.

We welcome all questions and inquiries re Building the Winning Nano Team.

© Copyright 2006 Bo Varga

|

Bo Varga is the Managing Director of Silicon Valley Nano Ventures.

Bo has 30 years business development and team building experience. His primary focus is to bring money to companies via angel, corporate, or VC investment, strategic alliances, development partnerships, or OEM sales. Bo has operations, sales, & marketing management experience in computer software & peripherals and in leading edge reconfigurable computing systems. He has worked with wireless, nanotechnology, reconfigurable computing, information technology, & ecommerce companies in team-building or business development roles.

He has helped executives, investors, and Boards of Directors for software, hardware, IS/IT, molecular engineering, & wireless companies by finding key team members and consultants for both technical & business positions.

His experience includes working as a strategic consultant to develop & implement marketing plans & presentations, with a specific focus on affiliate & event marketing to close business transactions. His focus since 2000 is on building global nanotechnology business networks via the nanoSIG & various nanotechnology conferences, forums, and symposiums. He is Chair of the NanoMaterials & Manufacturing Forum. Since 2001 he has organized over 60 nanotechnology events. His education includes a BA & MA from the University of Chicago and the MBA program in Accounting at UC Berkeley.

For more information on his work, see www.nanoSIG.org, www.USnano.biz.

He can be reached at bvarga@USnano.biz, or 650-747-9238 for more information.

|

Quotes

Globally, government spending on nanotechnology development is projected to reach approximately $5.0 billion (U.S.) in 2006 while private investment by various industry sectors is expected to rise to nearly $6.0 billion in the same period. link

"It has been estimated that within the next two decades the world's energy needs will nearly triple. This pressure will cause the market to look at a variety of ways to improve existing energy supplies as well as look for new alternative energy sources. Which energy source(s) will win out in the commercial marketplace is difficult to predict. What is not difficult to predict, however, is whether nanotechnology will play a large role." —Jack Uldrich Nanotech Investing: A Primer

"With four nanotech IPOs since the beginning of 2004 and multiple start-ups primed for public offerings or acquisitions, venture capital investments in nanotech will continue to rise. At the same time, investors in second-tier start-ups will be pushing their portfolio companies more aggressively towards exits. This will drive a round of consolidation between nanotech start-ups this year - and present opportunities for inexpensive acquisitions on the part of large corporations." —Matthew M. Nordan, VP Research, Lux Research

"If nanotechnology is to fulfill its enormous economic potential, then we have to invest more right now in understanding what problems the technology might cause," —Rep. Sherwood Boehlert, R-N.Y., Chairman of the House Science Committee. "This is the time to act, before we cause problems. This is the time to act, when there is a consensus among government, industry and environmentalists." link

"If we don't get in early on nanotechnology, we will miss an incredible opportunity. We must aggressively go after research funding and business investment. If it's going to be a California industry, we must act now and invest in education and our innovation infrastructure." —Steve Westly, Controller, State of California

"The first nanoscale computer memory device is slated to hit the streets this year. In 2007, the Food and Drug Administration is expected to have approved the first medical device incorporating nanotechnology, and by 2008, nanotechnology enabled solar cells (as thin as wallpaper) will be rolling off presses in California and Japan. As a result, the computer, medical device and energy industries are likely to undergo significant change." —Jack Uldrich link

"Competition in nanotechnology is global in nature. Other countries, such as Japan and China are making tremendous investments and it's critical that we maintain global leadership. Bringing private industry into research is one of the best ways I know to move science from theory to reality." —Senator Gordon Smith (R-OR) link

"One of the exciting yet challenging aspects of nanotechnology investing is the rich variety of opportunities -- from new tools that are essential to some aspect of getting a nanotechnology to market in the near term; to materials that disrupt the economics of a market that is large today; to the really cool science that may have a commercial application some day." —David Aslin, a West Coast partner at 3i link

"With instruments and tools, investors must identify those companies pursuing markets large enough to generate great returns - typically more than the research market. With bulk nanomaterials, it is all too easy to fall into the commodities trap. Investors must identify and bet on those companies in the value chain that are in a position to capture the lion's share of the value-added that their products and technology create." —Norm Wu, Managing Director of Alameda Capital link

"The United States is currently ahead of the nanotechnology curve, but other nations continue to invest more and more time, energy and money in their nanotechnology efforts. Our last stronghold of competition is innovation, and the United States cannot afford to lose the lead on this technology." —U.S. Representative Bob Inglis (R-SC)

"If you think that investing in nanotechnology is a quick, easy road to riches you're wrong. Nanotechnology will create a lot of new wealth and it will destroy a lot of old wealth but it will not, as a general rule, do these things overnight. Rather, it will do so over a period of years and, accordingly, investors of nanotechnology will need to demonstrate some patience." —Jack Uldrich, President of The NanoVeritas Group.

"Investing in innovation is the key to a vibrant US manufacturing base and the continued generation of new jobs. Nanotechnology has the potential to create entirely new industries and radically transform the basis of competition in other fields." —U.S. Representative Mike Honda (D-Cal.)

(RE: investing in a company) "The most important thing to look at is the people who are there. Read their bios. Do they have accomplishments or an ambiguous past? Is there a customer need for what they're selling? Do they have anything more than intellectual property? Is it a big market? Are competitors breaking new ground?" —Warren Packard, a venture capitalist at Draper Fisher Jurvetson

"... a company's involvement in nanotechnology today is one practical way of gauging whether they, at least, understand the forces which will allow them to still be in existence in 2025." —Jack Uldrich, NanoNovus

"It will take many years of substantial federal investment for the nanotechnology industry to achieve maturity, and it is critical that the President has structures in place to ensure that the U.S. leads the world in development. Additionally, nanotechnology will give rise to a host of novel social, ethical, philosophical and legal issues. It will be important to have a group in place to predict and work to alleviate anticipated problems." —Rep. Mike Honda (D-Cal.)

''To help America embrace the competitive challenges we face, we must invest in promising new technologies and high-growth industries that will lead to the jobs of the future," —Senator Edward M. Kennedy

"Critical investment in nanotechnology today will lead to discoveries tomorrow that are now beyond our own imagination. Nanotechnology's potential to change the way we invent and create is almost limitless." —Senator Gordon Smith (R-OR)

"Organizations as diverse as environmental NGOs, large chemical companies, nanotech startups, insurance companies and investment firms all agree that the federal government should be immediately directing many more of the dollars it is currently investing in nanotechnology development toward identifying and assessing the potential risks of nanomaterials to human health and the environment." —Richard Denison, Senior Scientist for Environmental Defense link

The car industry is currently investing more than $1 billion annually in hydrogen fuel cell technology. The federal government has pledged more than $1 billion over four years. link

"Nanotechnology, over the course of the next decade, will create a lot of new wealth, and it will also destroy a lot of old wealth - by rendering old businesses as well as business models obsolete. It will not do these things overnight. Instead, it will do so incrementally. As such, now is the time for prudent investors to begin familiarizing themselves with nanotechnology." —Jack Uldrich link

News

"Investing" News: April 01, 2006 - April 30, 2006

Making a grab for the chips

timesunion.com April 30, 2006 About 3 years ago, Gov. George Pataki announced the state and TEL would invest $300 million over seven years in a new research and development center at the University at Albany's College of Nanoscale Science and Engineering. The state's portion is $100 million; TEL is spending $200 million.

Imago raises $3.4 million

jsonline.com April 28, 2006 The Madison nanotechnology toolmaker will use the money to support the increase in operations that resulted from the acquisition and accelerate product line development at the company it acquired, said Timothy Stultz, Imago president and chief executive officer.

Nanochip secures $10 million in series C Funding

euroasiasemiconductor.com April 28, 2006 Nanochip is developing a new class of ultra-high-capacity MEMS-based storage chips. These new chips with bit-densities enabling the storage of tens of gigabytes per chip or the equivalent of many high-definition feature-length videos use a nano-probe array technology.

BASF to take Nanotechnology to Asia

foodingredientsfirst.com April 28, 2006 BASF has opened its first research center for nanotechnology in Asia. The new center in Singapore involves a €13 million expenditure up to 2008, and will employ 20 staff, mainly scientists and technicians. BASF already operates 17 development sites in Asia Pacific, but this is the first time the company is carrying out research dedicated only to nanotechnology in the region.

Malaysia To Invest In Nanotechnology

bernama.com.my April 27, 2006 Malaysia is looking to invest in the emerging field of nanotechnology which has the potential to dramatically improve warfare technology in the coming decades, says Deputy Prime Minister Datuk Seri Najib Tun Razak. He said today that active nanotechnology research currently was focusing on applications in information technology and medicine while potential military applications of nanotechnology lacked proper attention.

Raymor Industries Inc.: Private Placement of $10,000,000

marketwire April 27, 2006 Raymor Industries Inc. (TSX VENTURE:RAR), a leading developer and producer of single-walled carbon nanotubes, nanomaterials and advanced materials, is pleased to announce that the company has completed a private placement for 8,333,333 units.

SMI awarded Air Force Phase I STTR to develop Si based Laser

SMI April 27, 2006

Victoria scientist wins $1.2m grant

scoop.co.nz April 27, 2006 Cancerous tumours that hide inside the human body could soon be visualised by tiny ‘quantum dots,’ developed by a Victoria University chemistry lecturer and the focus of a new $1.26 million medical imaging research grant.

Dr Richard Tilley, from the School of Chemical & Physical Sciences and a Principal Investigator at the MacDiarmid Institute for Advanced Materials and Nanotechnology, is the principal researcher of a new collaboration, funded by the Foundation for Research, Science and Technology’s International Investment Opportunities Fund.

Abraxis BioScience to Acquire Manufacturing Complex from Pfizer

Abraxis BioScience April 26, 2006 Abraxis BioScience, Inc. (NASDAQ:ABBI), an integrated, global biopharmaceutical company, today announced that Abraxis and Pfizer Inc. (NYSE:PFE) have entered into a definitive purchase agreement whereby Abraxis will purchase Pfizer's Cruce Davila manufacturing facility in Barceloneta, Puerto Rico.

Aviza Technology Announces Shipment

businesswire April 26, 2006 Aviza Technology, Inc. (NASDAQ:AVZA), a supplier of advanced semiconductor equipment and process technologies for the global semiconductor, compound semiconductor, nanotechnology and other related markets, today announced the shipment of a Sigma(R) fxP(TM) metal deposition system to Freescale Semiconductor.

NanoNovus: April 26

NanoNovus April 26, 2006 Jack Uldrich: For investors, it is important to understand that nanoimrint lithography (NIL) will probably not be utilized by the semiconductor industry until around the 2011-2013 timeframe.

AMBIT Corporation announces Solar Energy Initiative

AMBIT Corporation April 26, 2006 Nanotube enhanced Solar Energy at top of Massachusetts firm’s investment plan

Ener1 Inc to Present at RedChip

prnewswire April 25, 2006 Ener1 Inc (OTC: ENEI) (BULLETIN BOARD: ENEI) , an alternative energy company, announced that it is scheduled to present at the RedChip Small Cap Investor Conference on Friday, April 28th at the Hard Rock Hotel and Casino in Hollywood, Florida.

Aviza Technology Announces Private Offering of Common Stock

businesswire April 25, 2006 Aviza Technology, Inc. (Nasdaq:AVZA) today announced that it has sold an aggregate of 3,282,275 shares of its common stock to Caisse de depot et placement du Quebec ("CDPQ") for an aggregate purchase price of $15 million in a private placement.

A “New” Player in Nano-Imprint Lithography

NanoNovus April 25, 2006 Jack Uldrich: In today’s Small Times newsletter there is an article about the EV Group selling a new nanoimprint lithography system to a German company. This is noteworthy for a couple of reasons. The first reason it is important (at least to me) is because up until today I was unaware that the EV Group even made nanoimprint equipment.

Valley's tax plea gets cool reception

msn.com April 24, 2006 Silicon Valley business leaders have narrowed the scope of a proposed tax break for manufacturers -- leaving out telecom -- in the hope that it will squeak through the Legislature, which let a similar tax break expire two years ago.

This year, in an attempt to pare back the cost of the bill, the authors removed telecom and focused the benefits on other technology, nanotech, aerospace and auto manufacturing.

Mousa merges bio, nano

ACBJ April 24, 2006 Shaker Mousa has what he calls his "biotech guys" and he has his "nano guys." Being able to put their heads together in the same place--the Pharmaceutical Research Institute at the Albany College of Pharmacy--is what Mousa says will make his operation a biomedical research success story.

Navigator Equity Solutions

presseportal.de April 24, 2006 Together with the Supervisory Board the Management of NAVIGATOR Equity Solutions N.V. has decided to distribute the participation in Nanoventure N.V. (www.nanoventure.de) as a share dividend to all shareholders of NAVIGATOR Equity Solutions N.V.. The execution of the transaction is expected to take place in the May 2006.

CombiMatrix Awarded Additional $1.9 Million Military Contract

businesswire April 24, 2006 Acacia Research Corporation (Nasdaq:CBMX)(Nasdaq:ACTG) announced today that its CombiMatrix group has received notification of a new award of $1.9 million from the Army Research Office. The objective of the contract is to develop a self-contained, fully integrated, automatic, and disposable device for detection of a wide variety of microorganisms within one hour.

Research consortium puts nano technology to the test

cosmeticsdesign-europe.com April 24, 2006 A German research consortium is investigating the effects of nanoparticles at the research and development stage in an effort to determine its effect on individuals' health as well as the environment. The project, which is being carried out by the UFZ Centre for Environmental Research in Leipzig, should prove particularly pertinent to small- and medium-sized cosmetics and personal care sector.

Nano Tech Firm Teams Up With Ga. Tech

localtechwire.com April 24, 2006 nGimat Co. will work with researchers at Georgia Tech and the Wright-Patterson AFB Air Research Laboratory to develop a fule injection model and advanced simulation tools for the injection of fuel in aero-propulsion systems during extreme operating conditions.

NYSTAR to deliver check for pilot plant

Alfred University April 24, 2006 Dr. Russell Bessette, executive director of the New York State office of Science, Technology and Academic Research (NYSTAR), will be in Alfred Thursday (April 27) to present a check for $1.8 million. The funds are a NYSTAR grant to the Alfred University Center for Advanced Ceramic Technology (CACT) and Clarkson University’s Center for Advanced Materials Processing (CAMP) to “develop pilot plant facilities and expertise in the synthesis of nano-sized particles and subsequent processing and consolidation into nano-structured ceramic components with enhanced properties.”

Nanotechnology joint venture lands €233m EC cash

electronicsweekly.com April 24, 2006 The European Commission (EC) has awarded a grant of €233m to the nanotechnology joint venture between Infineon Technologies, AMD and the German Fraunhofer Institute that opened in Dresden last year.

QSI Leverages Strong Business Fundamentals

QuantumSphere, Inc. April 24, 2006 Call for QSI-Nano™ Research Grant Proposals

Groundwork begins for ‘innovation pipeline' in nanotechnology

Arizona State University April 24, 2006 Work is set to start at ASU on building an “innovation pipeline” for turning discoveries in nanotechnology into business ventures. Groundwork for the endeavor – teaching students how to construct and use that pipeline – is kicking off with support from a $39,500 grant recently awarded by the National Collegiate Inventors and Innovators Alliance to a group of professors in ASU's Ira A. Fulton School of Engineering and College of Liberal Arts and Sciences. The funding will help launch an undergraduate honors course in the fall on the emerging field of nanotechnology and its commercial potential.

USC's Research Initiatives

thestate.com April 21, 2006 USC’s plan for a large new research campus in downtown Columbia is driven by initiatives in three key fields of scientific research:

NANOTECHNOLOGY, the study of extremely small particles and how they react differently than large groupings of basic elements. The field is expected to yield a variety of discoveries for commercial applications such as microcircuits and semiconductors.

Five new proposals granted funding

argonaut.uidaho.edu April 21, 2006 The University of Idaho has chosen five new programs that will share a $5.5 million investment over five years. One of the programs will develop research in nanotechnology for use in medicine and research. Graduate degrees and research funding will be offered through the program.

NanoNovus: April 21 (NanoChip & Bioforce)

NanoNovus April 21, 2006 Jack Uldrich: Intel Capital announced that it has invested $10 million in a Series C round of funding for Nanochip Inc, which is working on developing ultra-high-capacity memory. This is very positive news for both Nanochip and Intel.

Weifang wants investment from Portuguese chemical companies

macauhub.com.mo April 20, 2006 The city of Weifang, in the Chinese province of Shandong, wants to attract investment from the Portuguese chemical industry, Wang Xiulu, the city’s head of promotion and investment, said Wednesday. The Weifang government has said that preferential foreign investment sectors were nanotechnology, chemical engineering, new materials, electronics, information technology, and real estate development.

Nanogen to Acquire Amplimedical

prnewswire April 20, 2006 Nanogen, Inc. (Nasdaq: NGEN), developer and manufacturer of advanced diagnostic products, and Amplimedical S.p.A., a manufacturer of molecular diagnostic products and a wholly owned subsidiary of Amplifon (La Borsa: AMP), today announced that Nanogen will acquire the assets of Amplimedical's diagnostics division in a transaction of 8.1 million Euros consisting of 2.0 million Euros in cash and 6.1 million Euros in a promissory note convertible into Nanogen common shares.

South Africa: Thinking On a Grand Scale to Harness the Minuscule

allafrica.com April 20, 2006 Turning something very, very small into something very big for SA's economy is the ambitious aim of a R450m government investment into a rapidly evolving area of science. A R350m nanotechnology plant will be constructed at the Rand Refinery in Germiston if an experiment to use gold as a catalyst for chemical reactions proves commercially viable.

Fujitsu, Mitsui form quantum dot lasers venture

EETimes April 20, 2006 Finance has come from the venture capital arms of both conglomerates, and the venture will build on quantum dot laser research carried out by Fujitsu and the University of Tokyo. It will have starting capital of just over $300 million.

Investors Forum Day to Debut at NanoBusiness 2006

nanotechnologyinvestment.com April 20, 2006 As part of Investors Forum Day at NanoBusiness 2006, over 20 publicly and privately-held companies will make presentations to hundreds of attendees, focusing on their technologies, products, markets and corporate strategies. This marks the first time so many publicly-traded nanotechnology companies have presented in the same place at the same time.

H & H Group Makes Follow-on Investment In CSwitch

businesswire April 20, 2006 Harris & Harris Group, Inc. announced today that it has made a follow-on investment, in which it acted as the lead investor, as part of a $24 million Series B investment in CSwitch Corp.

Invitrogen and Signalomics agree nanotechnology diagnostics deal

outsourcing-pharma.com April 20, 2006 Invitrogen and Signalomics have agreed terms to develop nanotechnology-based laboratory approaches to cancer diagnostics in a move that is set to make the identification of tumours easier and quicker. Signalomics has become prominent in the nanocrystal field, becoming one of the first to develop a nanobiotechnology-based in vivo diagnostics platform by coupling designer proteins with fluorescent semiconductor crystals. These nanocrystal-protein conjugates, which are only a few millionths of a millimetre in size and are extremely photostable, can be targeted to faulty signalling proteins that are expressed in tumour tissue.

PXN Surpasses $100 Million in Assets

marketwire April 19, 2006 PowerShares Capital Management LLC, an asset management firm specializing in the development and management of Intelligent Exchange Traded Funds (ETFs), announced today that the PowerShares Lux Nanotech Portfolio (AMEX: PXN) has surpassed $100 million in assets under management.

President Discusses the American Competitiveness Initiative at Tuskegee University

whitehouse.gov April 19, 2006 President Bush: There's no telling what's going to come out of this basic research. As a matter of fact, I saw nanotechnology applied to what could conceivably be the next airplane wing. Boeing is funding research into nanotechnology here at Tuskegee, which may end up yielding a lighter, more firm material which could become the basis for the new airplanes that you fly in. It's lightweight stuff, but it's really strong.

New device revolutionizes spectrometry

UPI April 19, 2006 Florida Tech researchers said they will also use the device in a two-year nanotechnology project to develop a molecular photosensor.

NIH Funds Clinical Development of VivaGel(TM)

prnewswire April 19, 2006 Starpharma Holdings Limited (USOTC: SPHRY; ASX: SPL) today signed an agreement with the National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health (NIH), to fund a clinical trial to test the use of VivaGel(TM) in the prevention of genital herpes. Genital herpes is the second indication for which VivaGel(TM) is being developed. This latest support from the NIH is in addition to a previously announced US$20.3 (A$26m) million funding provided by the NIH to support the development of VivaGel(TM) for the prevention of HIV.

McMaster University Orders Two FEI Titan(TM) S/TEMs

prnewswire April 19, 2006 FEI Company (Nasdaq: FEIC) today announced that McMaster University, based in Ontario, Canada, has ordered two FEI Titan(TM) S/TEM systems - the world's first commercial systems capable of delivering sub-Angstrom resolution - and a multi-year service contract to support them. In dollars, it is one of the largest orders in recent FEI history.

A quiet policy shift for UK nanotechnology

Soft Machines April 19, 2006 Richard Jones: The centrepiece of the UK’s publically funded nanotechnology effort has been the Department of Trade and Industry’s Micro and Nanotechnology manufacturing initiative (MNT). This had a high profile launch in July 2003 in a speech by the science minister, Lord Sainsbury, with an initial commitment of £90 million. When, last year, the Secretary of State for Trade and Industry announced an increase of DTI nanotechnology funding to £200 million, the future of the MNT program seemed assured. But a close reading of recent announcements from the DTI make it clear that whatever extra funding they may be putting into nanotechnology, it’s not going into the MNT program.

Intel Capital leads new funding round

fabtech.org April 18, 2006 Intel Capital has invested $10 million US dollars in a Series C round of funding in Nanochip, Inc. The MEMS memory innovator plans to use the funds to perfect the technology in anticipation of bringing its first commercial product to the consumer market, though no timeframe was giving.

Nansulate Used in Construction of International Airport

primezone April 18, 2006 Industrial Nanotech (Pink Sheets:INTK), is pleased to announce that HH Robertson Asia/Pacific Group has placed an order for the Company's Nansulate coating to be used in the construction of the new state-of-the-art Suvanabhumi International Airport in Bangkok, Thailand.

NanoArrayer(TM) a Key Element in Harvard Research Project

genengnews.com April 18, 2006 BioForce Nanosciences (OTCBB:BFNH) has received a letter of intent to purchase a NanoArrayer(TM) System from the Technology & Engineering Center at the Harvard Medical School (HMS). Funding for the purchase will come from a National Human Genome Research Institute (NHGRI) award with purchase and installation of the technology expected later this summer.

Wafer supplier wins $1.6 billion solar order

EETimes April 18, 2006 Wafer supplier MEMC Electronic Materials Inc. said it has announced that it has signed a non-binding letter of intent (LOI) to supply wafers worth $1.6 billion to solar cell producer Motech Industries Inc. over an eight year period.

Nanoelectronics Training Program

SEMATECH April 18, 2006 Nanoelectronics is the foundation for emerging technologies that are expected to generate trillions of dollars in the future

€232.5 million for nanoelectronic technologies

europa.eu.int April 18, 2006 The European Commission has endorsed, under the EC Treaty’s rules on state aid, €232.5 million of public funding for a research and development project jointly set up by Infineon Technologies AG, Fraunhofer-Gesellschaft and Advanced Micro Devices Inc. (AMD) in Dresden, Germany (Saxony).

Turning cutting edge ideas into business success

gnn.gov.uk April 18, 2006 Cutting edge micro and nanotechnology projects across the UK are set to get a Government boost of nearly £10 million, Trade and Industry Secretary Alan Johnson announced today. One of the six projects to benefit is the Centre for Micro & Nano Moulding at the University of Bradford, which will receive £0.33m.

State aiming to be a 'nano hub'

shns.com April 18, 2006 Pennsylvania is taking part in a fierce competition to position itself to be the epicenter of nanotech - a science that by manipulating atoms and molecules promises to radically alter the way products are made and the world does business. Pennsylvania has spent $54 million since 1999 to try to capitalize on the much-hyped technology.

How to Invest in Nanotech

businessweek April 17, 2006 Nanotechnology should have a profound impact on virtually every business if implemented successfully. Although there are skeptics, the stock prices of companies using the technology, including blue chips IBM (IBM), Intel (INTC), and General Electric (GE), could benefit. In fact, an exchange-traded fund (ETF) devoted to nanotech is taking off.

Jack Uldrich, president of the consultancy NanoVeritas Group, estimates that corporations around the world will spend more than $10 billion on nanotechnology R&D in 2006. He indicates that he closely follows about 100 U.S.-based nanotech firms, of which 60% are privately held

Thin-film and Organic PV on the Rise

renewableenergyaccess.com April 17, 2006 The combination of better materials, the evolution of thin-film transistor technology, and new production methods is establishing thin-film and organic photovoltaics as a hot area for investment. ... thin-film is benefiting from a "perfect storm" of market drivers. Solar power of all kinds is attracting considerable interest, because of high prices and dire predictions for continued reliance on fossil fuels. And thin-film PV is getting particular attention, in part, because it gets around the current shortage of silicon that the traditional PV market is currently experiencing.

Inventors award ASU $39,500

eastvalleytribune.com April 17, 2006 A group of Arizona State University professors has received a grant from a national inventors organization to start an undergraduate honors course on the commercial potential of nanotechnology. The $39,500 grant from Massachusetts-based National Collegiate Inventors and Innovators Alliance will help ASU build an “innovation pipeline” for turning discoveries in nanotechnology into business ventures, the university said.

$1.8 Million Award For Nano-Enhanced SMC Scale-Up

e-composites.com April 17, 2006 The National Composite Center has been awarded a Third Frontier Project grant totaling $1,800,000. The Center will use the grant to launch a program for nano-enhanced sheet molding compound (SMC) scale-up for production of composite parts that retain the strength of conventional materials yet are significantly lighter and thinner.

Brazil Govt To Open New Agriculture Nanotech Lab

tmcnet.com April 17, 2006 The 700-square-meter, 4 million Brazilian real (US$1.8 million) lab, called the National Laboratory for Agricultural Nanotechnology, or LNNA, will be run by government research institution Embrapa.

ISE-CCM Nanotechnology Index Outperforms

dbusinessnews.com April 17, 2006 The ISE-CCM Nanotechnology Index (ISE: TNY) was up 15.43% for the year to date, versus 4.21% for the S&P 500, 4.24 % for the DJIA, and 6.37% for the Nasdaq.

Researcher thinks big about tiny things

columbiatribune.com April 16, 2006 For most of his 77 years, Fred Hawthorne has thought about boron. That element was the main focus of his 40 years of research at the University of California, Los Angeles. Now Hawthorne is setting up shop in Missouri as co-director of the new International Institute for Nano and Molecular Medicine at the University of Missouri-Columbia.

Cancer studies focus on early detection

miami.com April 16, 2006 ... the lion's share of attention has gone to figuring out how to treat existing cancers, not working toward earlier detection. That may be changing.

In recent years the National Cancer Institute has funneled tens of millions of dollars into early detection research. A $144 million program to fund nanotechnology and cancer research will go largely toward searching for new ways to catch cancers early.

Donation provides ability for advances in research

thetigernews.com April 14, 2006 Hitachi High Technologies has donated $1.65 million to match dollar-for-dollar the money donated by the South Carolina legislature's State Infrastructure Improvement Act. The biggest pride of Clemson's researchers is the $1.9 million KVTEM9500 microscope which will allow for greater advances in nanotechnology.

NanoNovus: April 14, 2006 (Raymor Industries)

NanoNovus April 14, 2006 Jack Uldrich: Canada’s National Post reported yesterday that Raymor Industries — a Montreal-based manufacturer of carbon nanotubes — is up 155% already this year. I have to apologize to my readers because, before yesterday, I wasn’t even aware of the company. I am not, however, beating myself up over this missed opportunity. As I say in my book, the nanomaterials market — and the carbon nanotube market in particular — is very competitive

UC Berkeley gets $500K gift for first nanotechnology chair

ACBJ April 14, 2006 The University of California at Berkeley will establish its first endowed chair in nanotechnology using a $500,000 gift from the executive chairman of Nanosys Inc. and his wife. Larry Bock and his wife, Diane, made the gift to the university's College of Chemistry.

ACP-affiliated scientific staff to double by the end of 2006

ACBJ April 14, 2006 The Albany, N.Y., College of Pharmacy-affiliated Pharmaceutical Research Institute expects to double the number of scientists on staff from 20 to 40 by the end of 2006 with the creation of a new Center for Nanopharmaceutical Sciences in East Greenbush.

Pataki vetoes funds for energy park nanotech center

ACBJ April 13, 2006 Fifteen million dollars that was supposed to finance an "international nanotechnology photovoltaic center" at the New York State Energy Research and Development Authority's Saratoga Technology and Energy Park fell victim to Gov. George Pataki's budget veto pen Thursday.

Party Committee sets out 5-year plan for HCM City development

vietnamnet.vn April 13, 2006 HCM City's Party Committee ended its third meeting recently with agreement to focus on five major programmes in the 2006-2010 period to spur economic growth.

The city wants to attract at least 10 foreign-invested companies with worldwide reputation in semi-conducting, information technology, post and telecommunications, new materials, nanotechnology, precise machinery, bio-technology and clean energy technology.

Cardiff Uni gets slice of nanotechnology millions

pingwales.co.uk April 13, 2006 Cardiff University’s new metaFAB project, led by Professor David Barrow, is among six micro- and nanotechnology projects across the UK to get a share of nearly £10m from the government. metaFAB is a component of the UK DTI MicroNanoTechnology Network.

Innovation seen as key to U.S. competitiveness

wpherald.com April 13, 2006 Jeffrey Sparshott: Konarka, an American company named for a Hindu temple dedicated to a sun god, is balancing a new line of products on the edge of science and manufacturing technology. The company's "power plastic" offers something along the lines of a flexible solar fabric that uses indoor or outdoor light to fuel products as small as a cell phone or as hefty as a vehicle.

NanoNovus: April 13, 2006

NanoNovus April 13, 2006 Jack Uldrich: Following on the heals of last weeks news about Cambrios’ new battery technology, two additional news items have served to further booster my optimism about Harris & Harris’ mid-term prospects.

The (still) Coming Nanotechnology Boom

TNTlog April 13, 2006 We have had a lot of fun in the past with the pundits in the investment world who like to trumpet that "Nanotechnology is on the verge of revolutionizing just about everything we do." Well perhaps it might, but investment advisors should really do their homework first.

UCR Engineering Professor is Malaria Detective

University of California, Riverside April 13, 2006 University of California, Riverside Electrical Engineering Assistant Professor Mihri Ozkan is part of a team receiving $75,000 from the National Academies Keck Futures Initiative to build a malaria diagnosis device.

Ozkan, a faculty member at UCR’s Bourns College of Engineering, will develop the nanotechnology needed for an inexpensive measuring device to detect active malaria infections in remote field settings where there is little or no electricity or medical expertise. The diagnostic tool will use microfluids, nanotechnology and genomics to diagnose the type and drug resistance of malaria parasites in humans.

ISE-CCM Nanotechnology Index

dbusinessnews.com April 12, 2006 Cronus Capital Markets and the International Securities Exchange jointly developed the ISE-CCM Nanotechnology index, which has options currently trading on the ISE (ISE:TNY).

Nanosys Announces Government Contract Awards

marketwire April 12, 2006 Nanosys, Inc. announced that it has been awarded new US government contracts that collectively total approximately $4.6 million.

Conference Agenda NanoBusiness 2006

businesswire April 12, 2006 The NanoBusiness Alliance, the world's leading nanotechnology trade association, today announced details of its conference program for the 5th annual NanoBusiness 2006 conference and exhibition, to be held May 17-19, 2006 at the Marriott Marquis hotel in New York City.

Smart Imaging takes on VC funding

ACBJ April 12, 2006 Software firm Smart Imaging Technologies Co. has received venture capital funding from Aegis Texas Venture Fund LP. Houston-based Smart Imaging, which specializes in nanoscale image analysis, will use the funds to expand sales and marketing operations in an effort to capitalize on growth opportunities in the nanotechnology, biotechnology and material science fields.

Turning Cutting Edge Ideas Into Business Success

harolddoan.com April 12, 2006 Cutting edge micro and nanotechnology projects across the UK are set to get a Government boost of nearly £10 million, Trade and Industry Secretary Alan Johnson announced today.

NanoNovus: April 12, 2006

NanoNovus April 12, 2006 Jack Uldrich: Yesterday was another busy day in the field of nanotechnology. Imago Scientific announced that it had purchased Oxford NanoScience — which was a subsidiary of Polaron. Both companies manufacture similar equipment and it is a strategic acquisition for Imago. I remain convinced, however, that Imago will itself become an acquistion target for one of the larger nanotech equipment suppliers like FEI, Veeco or JEOL. (more on other companies)

CombiMatrix and Texas A&M Receive Grant

businesswire April 11, 2006 Acacia Research Corporation (Nasdaq:CBMX)(Nasdaq:ACTG) announced today that its CombiMatrix group, in collaboration with Texas A&M University, has been awarded a National Academies Keck Futures Initiative grant (NAKFI). The grant will fund a novel method to increase the speed of hybridization in DNA microarray applications.

Polaron sells nanotechnology business

sharecast.com April 11, 2006 Nanotechnology firm Polaron said it has sold Oxford Nanoscience to Imago Scientific Instruments for $4.35m for a cash and stock deal.

Govt invests in Nanotechnology

buanews.gov.za April 11, 2006 Government will invest R170 million over the next three years to increase the number of Nanotechnology characterisation centres in South Africa. To guide the process, government has developed a strategy taking cognisance of local industry needs and focusing on the essential building blocks of Nanoscience, namely: synthesis, characterisation and fabrication.

Promoting economies of minuscule scale

northjersey.com April 11, 2006 On Wednesday, two Rutgers University experts in the emerging field of nanotechnology -- Eric Garfunkel, a professor of chemistry, and Yves Chabal, who heads the laboratory for surface modification -- will outline for state legislative staffers and lawmakers why investing state funds in research and development in this area will have long-term payoffs.

A good story, growth and a possible partnerships

NanoNovus April 11, 2006 Jack Uldrich: A couple of press releases caught my attention over the past few days. The first comes compliments of Aspen Aerogels — a private company I really like. The second item comes from NanoInk. The final release was from pSivida.

Consortium led by QinetiQ Nanomaterials Ltd wins £2m funding

QinetiQ Nanomaterials April 11, 2006 A consortium led by QinetiQ Nanomaterials Limited (QNL), a wholly owned QinetiQ subsidiary, is to develop a range of nanomaterials for use in the fight against a broad spectrum of viruses, it was announced today. The two year programme is being funded by the South East England Development Agency (SEEDA) which has allocated £2m to the project, their largest single investment in science and technology to date.

Singapore nanotech firm opens facility

EETimes April 11, 2006 Singaporean nanomaterial production specialist NanoMaterials Technology Pte. Ltd. officially opened a $1.5 million facility here. The company also has plans to go public in 2008, though it has yet to decide where it will list.

Exclusive Panel of Nanotechnology Experts

prnewswire April 11, 2006 Christian DeHaemer, editor of the increasingly popular investment publication Red Zone Profits, has gathered a panel of leading experts to discuss the coming nanotechnology boom. The discussion, now available via the Internet, offers investors the opportunity to safely profit on the impending nanotechnology boom. "The investment potential in nanotechnology could be greater than anything any investors have ever seen before, even greater than the buzz about the Internet back in 1993," says Mr. DeHaemer.

Venture capitalist anticipates growth in green technology

smdailyjournal.com April 10, 2006 Kleiner Perkins’ plan to ramp up investment in green technology is just the latest sign of the sector’s growth. Also known as clean technology, the field includes technologies related to water purification, air quality, nanotechnology, alternative fuels, manufacturing, recycling and renewable energy.

NanoMaterials Technology Opens New US$1.5 Million Facility

prnewswire April 10, 2006 Singapore-based NanoMaterials Technology Pte Ltd ("NMT"), a company that develops and commercialises production technologies for nanomaterials, opened its new US$1.54 million facility officially today.

Kemira acquires the business of Germain IFAC

kemira.com April 10, 2006 Kemira Oyj and the German company IFAC GmbH & Co. KG have reached an agreement about the acquisition of IFAC by Kemira. IFAC GmbH & Co. KG is privately-owned R&D company especially focused on R&D projects for cosmetics industries. IFAC is a leading development company in nanotechnology applications within cosmetics industries and it owns a strong patent portfolio within this application area.

Homegrown Nanomaterials Technology aims for 2008 listing

channelnewsasia.com April 10, 2006 Nanomaterials Technology, a homegrown laboratory, is aiming for a stock market listing in 2008. The firm, which opened a new S$2.5 million facility on Monday, is forecasting a huge jump in revenue growth to S$20 million within the next two years.

Directed Evolution: Cambrios

NanoNovus April 10, 2006 Jack Uldrich: Dr. Angela Belcher and a team of researchers at MIT reported that they had successfully created a battery that was assembled by a biological virus that binds gold and cobalt oxide.

Such a procedure might sound esoteric, and it might be even more difficult to imagine the commercial applications of a “virus-made” battery; but, in my opinion, this is very big news because such a procedure could revolutionize battery manufacturing.

UCSC receives funding for training grants

University of California, Santa Cruz April 10, 2006 The University of California, Santa Cruz, has received $375,000 from the California Institute for Regenerative Medicine (CIRM) to fund the first year of a new training program in stem cell research. CIRM announced today that it has distributed $12.1 million in grants to 16 California institutions as part of the CIRM Training Program.

The CIRM Training Program will educate fellows from a variety of scientific backgrounds, including computation and molecular biology, nanotechnology, and clinical medicine.

No needles, no fear

University of Queensland April 10, 2006 People who fear needles may one day have no need to fear the doctor, with the help of a funding injection for The University of Queensland`s Professor Mark Kendall. Professor Kendall today won a three year Queensland Government Smart State Senior Fellowship, gaining $300,000 to research how nanotechnology may replace syringes in administering therapeutics.

UQ leads new biomaterials alliance

University of Queensland April 10, 2006 A University of Queensland scientist will lead an International Biomaterials Research Alliance which has attracted $1.2 million funding announced today by the Queensland Government. Professor Andrew Whittaker of UQ's Centre for Magnetic Resonance and the Australian Institute for Bioengineering and Nanotechnology leads the $4 million project.

Newbridge Securities Releases Quarterly Update

emediawire.com April 09, 2006 Newbridge Securities Corporation today announced the release of the second quarter 2006 issue of Inside Nanotechnology. This 32-page report is the eighth quarterly installment in the series, which covers general developments affecting the commercialization of nanotechnology and in-depth analysis of the 24 companies that constitute the Newbridge Nanotechnology Index (NNIX).

Donors give $50M for U. Wisconsin research facility

smalltimes April 06, 2006 Donations in the amount of $150 million will fund a brand-new UW-Madison science research facility, Chancellor John Wiley announced Monday. The new Morgridge Institute for Research, named after UW alums and frequent donors John and Tashia Morgridge, will house scientific labs and classrooms.

Increasing US investment support for Starpharma

pharmalive.com April 06, 2006 Starpharma (ASX:SPL, USOTC:SPHRY) is capitalising on growing US investor interest in the company and its lead product VivaGelTM for the prevention of sexually transmitted infections. Starpharma’s American Depository Receipts (ADR) Program has been strongly supported since its inception in January 2005 and the number of ADRs outstanding has been growing at an average rate of 9% per month, increasing to more than 15% per month in early 2006.

€232.5M funding of US-German nanotechnology chip project

finfacts.com April 06, 2006 The European Commission has endorsed, under the EC Treaty’s rules on state aid, €232.5 million of public funding for a research and development project jointly set up by German chipmaker Infineon Technologies AG, German research institute Fraunhofer-Gesellschaft and US chip manufacturer Advanced Micro Devices Inc. (AMD) in Dresden, Germany.

Ener1 Stock Resumes Trading on OTC Bulletin Board

prnewswire April 06, 2006 Ener1, Inc. (OTC Bulletin Board: ENEI) announced today that, effective immediately, trading of its common stock has moved from the Pink Sheets to the Over TheCounter Bulletin Board under the trading symbol ENEI.

Nanotube factory set up in Wollongong

ferret.com.au April 06, 2006 The University of Wollongong’s Intelligent Polymer Research Institute (IBRI) has installed a machine that will allow its researchers to design and produce carbon nanotubes.

148 global corporations have nanotechnology initiatives today

Lux Research April 05, 2006 Lux Research kicks off client-only conference call series with exclusive analysis of best practices in nanotechnology commercialization

U.S. government launches nanotechnology center

manufacturing.net April 04, 2006 “The national Center for Nanoscale Science and Technology (CNST) will help the private sector develop innovative products like more efficient batteries, lighter-weight and higher-performing materials for aircraft and autos, and smaller computer chips to power digital devices,” said Gutierrez.

SUSS sells to MiPlaza

smalltimes April 04, 2006 SUSS MicroTec announced that Microsystems Plaza (MiPlaza), a MEMS and nanotechnology research and development facility and service provider at the HighTech Campus in Eindhoven, the Netherlands, has selected SUSS MicroTec wafer bonding equipment for the manufacture of MEMS and and biomedical devices.

Researchers win money to develop breath test to detect breast cancer