Home > Press > Harris & Harris Group Reports Financial Statements as of June 30, 2015, and Announces a Stock Repurchase Program

|

Abstract:

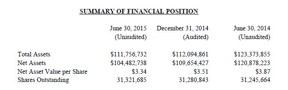

Harris & Harris Group, Inc. (Nasdaq: TINY) reported today that as of June 30, 2015, its net asset value and net asset value per share were $104,482,738 and $3.34, respectively. The Company also announced today that its Board of Directors has authorized the Company to repurchase shares of its outstanding common stock with an aggregate value of up to $2.5 million.

Harris & Harris Group Reports Financial Statements as of June 30, 2015, and Announces a Stock Repurchase Program

New York, NY | Posted on August 10th, 2015Over the last year, our shareholder letters and blogs have been very clear on our path forward. First, we are seeking to monetize our holdings that are not strategic to our growth or our BIOLOGY+ investment thesis. Key events through June 30, 2015, that support this monetization include the following:

In May 2015, the spin-out of Molecular Imprints, Inc.'s, ("MII") non-semiconductor business was acquired by a privately held company. Upon closing of the transaction, we received our initial payment of $705,794 and 24,897 shares of the acquiring company. As of June 30, 2015, additional proceeds of $126,972 and 4,394 shares of Series B Preferred Stock of the acquiring party are held in an indemnity escrow and $3,386 is held in a stockholder representative funding escrow until May 1, 2016. There can be no assurance as to how much of these amounts we will ultimately realize. The proceeds from this sale are in addition to those we received from the sale of MII's CMOS business during 2014 to Canon; and

In June 2015, we sold our shares of Nantero, Inc. for $4,828,053 to an undisclosed party. We realized a gain of $3,109,347 on invested capital of $1,718,706, or a 2.8 times return. We have been a part of the investor syndicate of Nantero since its inception, and we believe it has a promising future.

We have also had a number of events occur subsequent to the end of the second quarter that support our monetization goal including:

In July 2015, Bridgelux, Inc., signed a definitive agreement to be acquired by an investment group led by China Electronics Corporation and ChongQing Linkong Development Investment Company. The close of this transaction is subject to customary regulatory approvals. We expect to receive cash proceeds from the sale in an amount to be finalized upon closing. In addition to the cash proceeds, we will receive equity of Xenio Corporation, a spin-off company focused on commercializing Bridgelux's smart lighting business to address the emerging $135 billion lighting opportunity in the Internet of Things ("IoT") market. We invested a total of $5.4 million in Bridgelux, beginning with our initial investment in 2005 and valued our securities of the company at $2.5 million as of June 30, 2015;

In July 2015, SynGlyco, Inc., negotiated the acceleration and settlement of payments due to it from the sale of its synthesis business to Corden Pharmaceuticals. This acceleration of payments yielded proceeds that paid off in full our senior secured debt investment with a payment to us of approximately $565,000. We expect to receive additional repayments for our outstanding secured convertible bridge notes of approximately $750,000 from this transaction. Additionally, SynGlyco entered into two license agreements that may provide additional payments in the future. These payments will bring our total cash distributions from this investment to approximately $1.7 million. We invested a total of $8.8 million in SynGlyco, beginning with our initial investment in 2007 and valued our securities of the company at $1.5 million as of June 30, 2015; and

In August 2015, SiOnyx, Inc., reorganized its corporate structure to become a subsidiary of a new company, Black Silicon Holdings, Inc. Our security holdings of SiOnyx converted into securities of Black Silicon Holdings, Inc. SiOnyx was then acquired by an undisclosed buyer. We received cash and a profit interest in the undisclosed buyer that is held through our ownership in Black Silicon Holdings, Inc. We invested a total of $8.5 million in SiOnyx beginning with our initial investment in 2006 and valued our securities of the company at $2.9 million as of June 30, 2015.

Second, we have focused our time and resources on a smaller set of companies that we believe have the potential to drive value for Harris & Harris Group shareholders in the future. Key events through June 30, 2015, and events that have occurred subsequent to the end of the second quarter that support this goal include the following:

OpGen, Inc., completed its initial public offering (IPO) raising $17.1 million. Its common stock and warrants for the purchase of common stock now trade on Nasdaq under the ticker symbols OPGN and OPGNW, respectively. OpGen also received an investment of $6 million from the Merck Global Health Innovation Fund (Merck GHI) and announced the acquisition of AvanDx, a developer of advanced molecular diagnostic products;

D-Wave Systems, Inc., announced that it has successfully fabricated 1,000 qubit processors that power its quantum computers. At 1,000 qubits, the new processor considers 21,000 possibilities simultaneously, a search space which is substantially larger than the 2,512 possibilities available to the company's currently available 512 qubit D-Wave Two;

AgBiome, LLC, formed a strategic partnership with Genective, a leading developer of biotech crops, to accelerate the discovery of a new generation of insect control traits;

HZO, Inc., completed an oversubscribed extension of its Series II round financing from existing investors at the same price per share as the original close. HZO also announced partnerships with Dell and Motorola; and

ORIG3N, Inc., completed the commercial milestones for triggering the investment of the second tranche of its Series A round of financing ahead of schedule.

Third, we do not believe our stock price reflects the current or future value of the companies we are a part of building at Harris & Harris Group. When there is such a disconnect in the potential value of our Company and the price reflected in the stock, we believe one of the best investments we can make is in our own stock. Utilizing the cash the Company has received from the monetization of some of our portfolio companies in 2015, our Board of Directors has authorized the repurchase of up to $2.5 million of our shares in the open market at prices that may be above or below the net asset value as reported in our most recently published financial statements. We anticipate that the manner, timing, and amount of any share purchases will be determined by our management based upon the evaluation of market conditions, stock price, and additional factors in accordance with regulatory requirements.

Pursuant to the Investment Company Act of 1940, as amended, we are required to notify shareholders when such a program is initiated or implemented. The repurchase program does not require us to acquire any specific number of shares and may be extended, modified, or discontinued at any time.

"Strategically, the second quarter of 2015 was another step forward for the companies that we believe will drive value for Harris & Harris Group over the next few years. Positive events are happening at D-Wave, AgBiome, Metabolon, HZO and Adesto to name just a few," said Doug Jamison, CEO of Harris & Harris Group. "Tactically, we have also been successful generating liquidity events in 2015, and we remain focused on additional liquidity events in 2015 and 2016. Additionally, our current portfolio is well positioned in the important growth areas of quantum computing, machine learning, the microbiome, agtech, regenerative medicine and the Internet of Things."

####

About Harris & Harris Group, Inc.

Harris & Harris Group is a publicly traded venture capital firm that is also a business development company. Detailed information about Harris & Harris Group and its holdings can be found on its website at www.HHVC.com, on Facebook at www.facebook.com/harrisharrisvc and by following on Twitter @harrisandharrisgroup.

This press release may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as well as subsequent filings, filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business, including, but not limited to, the risks and uncertainties associated with venture capital investing and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The references to the websites www.HHVC.com and www.Facebook.com have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this press release. Harris & Harris Group is not responsible for the contents of third party websites.

For more information, please click here

Contacts:

DOUGLAS W. JAMISON

TEL. NO. (212) 582-0900

Copyright © Harris & Harris Group, Inc.

If you have a comment, please Contact us.Issuers of news releases, not 7th Wave, Inc. or Nanotechnology Now, are solely responsible for the accuracy of the content.

| Related News Press |

News and information

![]() Decoding hydrogen‑bond network of electrolyte for cryogenic durable aqueous zinc‑ion batteries January 30th, 2026

Decoding hydrogen‑bond network of electrolyte for cryogenic durable aqueous zinc‑ion batteries January 30th, 2026

![]() COF scaffold membrane with gate‑lane nanostructure for efficient Li+/Mg2+ separation January 30th, 2026

COF scaffold membrane with gate‑lane nanostructure for efficient Li+/Mg2+ separation January 30th, 2026

Internet-of-Things

![]() Nanofibrous metal oxide semiconductor for sensory face November 8th, 2024

Nanofibrous metal oxide semiconductor for sensory face November 8th, 2024

![]() New nanowire sensors are the next step in the Internet of Things January 6th, 2023

New nanowire sensors are the next step in the Internet of Things January 6th, 2023

![]() New chip ramps up AI computing efficiency August 19th, 2022

New chip ramps up AI computing efficiency August 19th, 2022

![]() Lightening up the nanoscale long-wavelength optoelectronics May 13th, 2022

Lightening up the nanoscale long-wavelength optoelectronics May 13th, 2022

VC/Funding/Angel financing/Loans/Leases/Crowdfunding

![]() Graphene Flagship start-up Bedimensional closes a second €10 million investment round February 10th, 2023

Graphene Flagship start-up Bedimensional closes a second €10 million investment round February 10th, 2023

Possible Futures

![]() Decoding hydrogen‑bond network of electrolyte for cryogenic durable aqueous zinc‑ion batteries January 30th, 2026

Decoding hydrogen‑bond network of electrolyte for cryogenic durable aqueous zinc‑ion batteries January 30th, 2026

![]() COF scaffold membrane with gate‑lane nanostructure for efficient Li+/Mg2+ separation January 30th, 2026

COF scaffold membrane with gate‑lane nanostructure for efficient Li+/Mg2+ separation January 30th, 2026

Investments/IPO's/Splits

![]() Daikin Industries becomes OCSiAl shareholder July 27th, 2021

Daikin Industries becomes OCSiAl shareholder July 27th, 2021

![]() INBRAIN Neuroelectronics raises over €14M to develop smart graphene-based neural implants for personalised therapies in brain disorders March 26th, 2021

INBRAIN Neuroelectronics raises over €14M to develop smart graphene-based neural implants for personalised therapies in brain disorders March 26th, 2021

![]() 180 Degree Capital Corp. Issues Second Open Letter to the Board and Shareholders of Enzo Biochem, Inc. March 26th, 2021

180 Degree Capital Corp. Issues Second Open Letter to the Board and Shareholders of Enzo Biochem, Inc. March 26th, 2021

Quantum Computing

![]() Researchers develop molecular qubits that communicate at telecom frequencies October 3rd, 2025

Researchers develop molecular qubits that communicate at telecom frequencies October 3rd, 2025

![]() Researchers tackle the memory bottleneck stalling quantum computing October 3rd, 2025

Researchers tackle the memory bottleneck stalling quantum computing October 3rd, 2025

![]() Japan launches fully domestically produced quantum computer: Expo visitors to experience quantum computing firsthand August 8th, 2025

Japan launches fully domestically produced quantum computer: Expo visitors to experience quantum computing firsthand August 8th, 2025

Announcements

![]() Decoding hydrogen‑bond network of electrolyte for cryogenic durable aqueous zinc‑ion batteries January 30th, 2026

Decoding hydrogen‑bond network of electrolyte for cryogenic durable aqueous zinc‑ion batteries January 30th, 2026

![]() COF scaffold membrane with gate‑lane nanostructure for efficient Li+/Mg2+ separation January 30th, 2026

COF scaffold membrane with gate‑lane nanostructure for efficient Li+/Mg2+ separation January 30th, 2026

Financial Reports

![]() Arrowhead Pharmaceuticals to Webcast Fiscal 2021 Second Quarter Results April 16th, 2021

Arrowhead Pharmaceuticals to Webcast Fiscal 2021 Second Quarter Results April 16th, 2021

![]() Arrowhead Pharmaceuticals to Webcast Fiscal 2021 Second Quarter Results April 16th, 2021

Arrowhead Pharmaceuticals to Webcast Fiscal 2021 Second Quarter Results April 16th, 2021

Food/Agriculture/Supplements

![]() New imaging approach transforms study of bacterial biofilms August 8th, 2025

New imaging approach transforms study of bacterial biofilms August 8th, 2025

![]() SMART researchers pioneer first-of-its-kind nanosensor for real-time iron detection in plants February 28th, 2025

SMART researchers pioneer first-of-its-kind nanosensor for real-time iron detection in plants February 28th, 2025

![]() Silver nanoparticles: guaranteeing antimicrobial safe-tea November 17th, 2023

Silver nanoparticles: guaranteeing antimicrobial safe-tea November 17th, 2023

|

|

||

|

|

||

| The latest news from around the world, FREE | ||

|

|

||

|

|

||

| Premium Products | ||

|

|

||

|

Only the news you want to read!

Learn More |

||

|

|

||

|

Full-service, expert consulting

Learn More |

||

|

|

||