Home > Press > Nanometrics Reports Third Quarter 2012 Financial Results

|

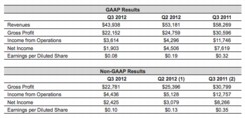

| A reconciliation between GAAP operating results and non-GAAP operating results is provided following the financial statements that are part of this release and on the investor page of our website. Non-GAAP results for all periods presented exclude the impact of amortization of acquired intangible assets.

(1) Non-GAAP results for Q2 2012 exclude the tax benefit of $0.7 million related to certain foreign losses, which were recorded in the non-GAAP results for Q1 2012 but not recorded for GAAP purposes until Q2 2012, because company elections that enabled recognition of these benefits were not approved by the IRS until Q2. GAAP results for Q2 2012 include both Q1 2012 and Q2 2012 benefits associated with these certain foreign losses. See also footnote (a) to the Reconciliation of GAAP to Non-GAAP financial results. (2) Non-GAAP results for Q3 2011 exclude certain acquisition-related charges. |

Abstract:

Nanometrics Incorporated (NASDAQ: NANO), a leading provider of advanced process control metrology and inspection systems, today announced financial results for its third quarter ended September 29, 2012.

Third Quarter Highlights

- Revenues of $43.9 million; with improved gross and operating margins compared to the first and second quarters of 2012;

- Revenue recognized on the company's first 450mm Atlas® metrology system, which was shipped mid-year; and

- Additional penetration of major foundry customers, across several product lines, including front-end-of-line applications for the UniFire®, Atlas II, and IMPULSE® integrated metrology.

Nanometrics Reports Third Quarter 2012 Financial Results

Milpitas, CA | Posted on November 1st, 2012Commenting on the company's results, president and chief executive officer Dr. Timothy J. Stultz said, "We are pleased to report a second quarter of sequential improvement in both gross margin and operating margin against the headwind of reduced levels of industry spending and the associated decline in our revenues. During the current industry downturn we intend to continue to strengthen our position within key customer accounts, expand our penetration into the foundry segment, and drive further adoption of our UniFire and SPARK platforms within the growth markets of Inspection and Advanced Packaging. As we witnessed in 2009, industry slowdowns and technological inflection points create unique opportunities to expand our market position and served markets - setting the stage for growth and outperformance when industry spending resumes. We see similar opportunities at this time, and are further encouraged by the fact that we have a larger product and platform portfolio, and a greater number of key customer engagements, than ever before."

Third Quarter 2012 Summary

Revenues for the third quarter of 2012 were $43.9 million, down 17% from $53.2 million in the second quarter and down 25% from $58.3 million in the third quarter of 2011. GAAP gross margin was 50.4%, compared to 46.6% in the prior quarter and 52.5% in the year-ago period. Non-GAAP gross margin, which excludes amortization of acquired intangible assets, was 51.8%, compared to 47.8% in the prior quarter and 52.9% in the year-ago period. The improvement in gross margin compared to the second quarter of 2012 was primarily driven by higher product gross margin, as a result of an increase in standard tool margin as well as a decrease in warranty, obsolescence and other manufacturing costs.

GAAP operating income was $3.6 million, compared to $4.3 million in the prior quarter and $11.7 million in the year-ago period. Non-GAAP operating income was $4.4 million, compared to $5.1 million in the prior quarter and $12.8 million in the third quarter of 2011.

GAAP net income was $1.9 million or $0.08 per diluted share, compared to $4.5 million or $0.19 per diluted share in the prior quarter and $7.6 million or $0.32 per diluted share in the third quarter of 2011. Non-GAAP net income was $2.4 million or $0.10 per diluted share, compared to $3.1 million or $0.13 per diluted share in the prior quarter and $8.3 million or $0.35 per diluted share in the third quarter of 2011.

At September 29, 2012, Nanometrics had $104.8 million in cash, cash equivalents and marketable securities and $165.1 million in working capital. Stockholders' equity, excluding intangible assets, was $199.6 million, or $8.54 per share based on 23.4 million shares outstanding at quarter end.

Business Outlook

Management forecasts continued declines in industry spending in the fourth quarter, with total revenues expected to be in the range of $28 to $32 million. Management expects GAAP gross margin in the range of 40% to 44%, non-GAAP gross margin in the range of 42% to 46%, and operating expenses to increase between $0.4 to $0.9 million from the third quarter. Management expects the fourth quarter GAAP net loss to be in the range of $0.14 to $0.21 per share and the non-GAAP net loss to be in the range of $0.12 to $0.19 per share.

For NANO Q3-2012 tables, please visit www.nanometrics.com.

Conference Call Details

A conference call to discuss third quarter 2012 results will be held today at 4:30 p.m. EDT (1:30 p.m. PDT). To participate in the conference call, the dial-in numbers are (877) 374-4041 for domestic callers and (253) 237-1156 for international callers. A live and recorded webcast will be made available on the investor page of the Nanometrics website at www.nanometrics.com.

Use of Non-GAAP Financial Information

Financial results such as non-GAAP gross profit, operating income, net income and net income per share, which exclude certain expenses, charges and special items, were not prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Management uses non-GAAP financial results, which exclude acquisition-related expenses such as amortization of acquired intangibles and transaction costs, asset impairments, restructuring charges, legal settlements, certain discrete tax items and the impact of the timing of the approval of elections related to tax treatment of certain foreign subsidiaries, and other unusual and infrequent items to evaluate the company's ongoing performance and to enable comparison to other periods that did not include these unusual and infrequent items. The company believes the presentation of non-GAAP results is useful to investors for analyzing ongoing business trends, comparing performance to prior periods, and enhancing the investor's ability to view the company's results from management's perspective. A table presenting a reconciliation of GAAP results to non-GAAP results is included at the end of this press release and is available on the investor page of the Nanometrics website at www.nanometrics.com.

####

About Nanometrics Incorporated

Nanometrics is a leading provider of advanced, high-performance process control metrology and inspection systems used primarily in the fabrication of semiconductors, high-brightness LEDs, data storage devices and solar photovoltaics. Nanometrics’ automated and integrated systems address numerous process control applications, including critical dimension and film thickness measurement, device topography, defect inspection, overlay registration, and analysis of various other film properties such as optical, electrical and material characteristics. The company’s process control solutions are deployed throughout the fabrication process, from front-end-of-line substrate manufacturing, to high-volume production of semiconductors and other devices, to advanced wafer-scale packaging applications. Nanometrics’ systems enable device manufacturers to improve yields, increase productivity and lower their manufacturing costs. The company maintains its headquarters in Milpitas, California, with sales and service offices worldwide. Nanometrics is traded on NASDAQ Global Select Market under the symbol NANO.

Forward Looking Statements

This press release contains forward-looking statements including, but not limited to, statements included in the quotation from management and statements included in the business outlook section, such as the statements regarding future revenue, margins, profitability, opportunities, areas of market growth and product adoption. These forward-looking statements may also be identified by words such as “expect,” “anticipate,” “believe,” “estimate,” “forecasts,” “plan,” “predict,” “view,” and similar terms. Although Nanometrics believes that the expectations reflected in the forward-looking statements are reasonable, actual results could differ materially from these expectations due to a variety of factors, including economic conditions, levels of industry spending, shifts in the timing of customer orders and product shipments, market adoption rates, changes in product mix, our ability to implement supply cost reductions, and increased operating expenses. For additional information and considerations regarding the risks faced by Nanometrics, see its annual report on Form 10-K for the year ended December 31, 2011 as filed with the Securities and Exchange Commission, as well as other periodic reports filed with the SEC from time to time. Nanometrics disclaims any obligation to update information contained in any forward-looking statement.

For more information, please click here

Contacts:

Company Contact:

Ronald Kisling, CFO

408-545-6143

Investor Relations Contact:

Claire McAdams

Headgate Partners LLC

530-265-9899

Copyright © Nanometrics Incorporated

If you have a comment, please Contact us.Issuers of news releases, not 7th Wave, Inc. or Nanotechnology Now, are solely responsible for the accuracy of the content.

| Related News Press |

|

|

||

|

|

||

| The latest news from around the world, FREE | ||

|

|

||

|

|

||

| Premium Products | ||

|

|

||

|

Only the news you want to read!

Learn More |

||

|

|

||

|

Full-service, expert consulting

Learn More |

||

|

|

||